34+ Mortgage calculator with taxes pmi

Second mortgage types Lump sum. This will be the only land payment calculator that you will ever need whether you want to calculate payments for residential or commercial lands.

Printable Sample Contract To Sell On Land Contract Form Contract Template Things To Sell Purchase Contract

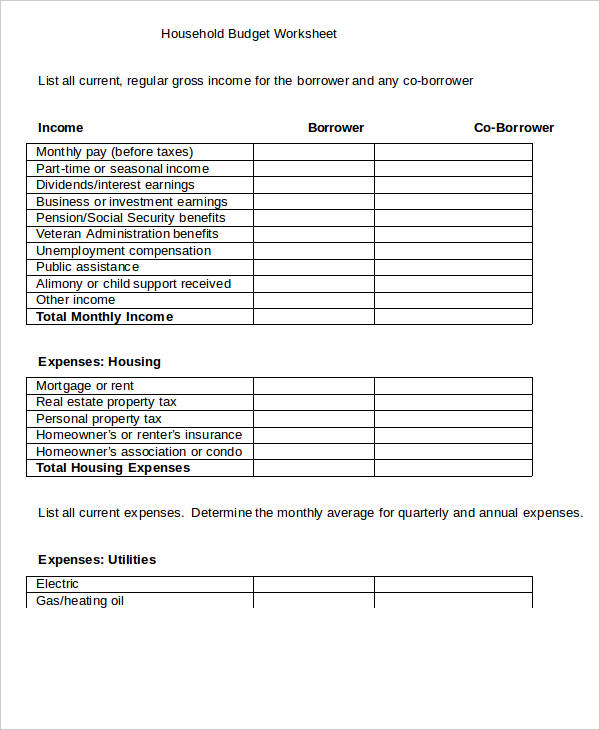

Most lenders allow you to pay for your yearly property taxes when you make your monthly mortgage payment.

. Use this free Texas Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. As a basic calculator it quickly figures the principal interest payments on a fixed-rate loan. However you could pay as much as a couple hundred dollars each month for PMI in addition to your principle and interest.

Sale Price - Down Payment Points if. The land mortgage calculator returns the payoff date total payment and total interest payment for your mortgage. With a 30-year fixed-rate mortgage you have a lower monthly payment but youll pay more in interest over time.

Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. The free mortgage calculator is a versatile tool as useful to an individual casually researching properties as it is to someone on the cusp of making a purchase. When youre calculating the costs of buying a home youll need to think about property taxes in addition to your monthly mortgage payments.

Todays national mortgage rate trends. Use this free tool to figure your monthly payments for a given loan amount. PMI is typically included in monthly mortgage payments which may cost anywhere between 025 to 2.

The mortgage calculator spreadsheet has a mortgage amortization schedule that is printable and exportable to excel and pdf. Property taxes in the state rank 17th-lowest in the country based on Census data. Make An Informed Decision.

Get 247 customer support help when you place a homework help service order with us. The above calculator is for fixed-rate mortgages. Some may even.

Loan Term 10-YR FRM 15-YR FRM 20-YR FRM 30-YR FRM. See how your monthly payment changes by making updates to. We considered closing costs real estate taxes homeowners insurance and mortgage payments to determine the rankings.

On Wednesday September 07 2022 the current average 30-year fixed-mortgage rate is 602 increasing 8 basis points over the last week. 15 Year Fixed Rate Mortgage Calculator. Across the United States 88 of home buyers finance their purchases with a mortgage.

The monthly payment and interest are calculated as if the mortgage or loan were being paid over this length. Actual payment could include escrow for insurance and property taxes plus private mortgage insurance PMI. Mortgage Calculator Excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments.

Factors in Your Florida Mortgage Payment. If you would like to calculate all-in payments with other factors like PMI homeowners insurance property taxes points HOA fees please use our advanced calculator. This printable amortization schedule will help you to get a month by month calendar of exactly how much of your monthly income will be devoted to paying off your mortgage.

Luckily Floridians dont have it bad with tax rates near or below the national average. Monthly Taxes Insurance and PMI payment. If a loan is named a 51 ARM then what that means is the loan is fixed for the first 5 years then the rate resets each year thereafter.

All statistics in this calendar are in expressed in nominal. Some conventional lenders will accept down payments as low as 3 but youll most likely need to purchase private mortgage insurance PMI to secure the loan. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination.

This would presume no closing costs no major home repairs. The median forecasts in this calendar come from surveys of economists conducted by Dow Jones Newswires and The Wall Street Journal. Lenders typically require a down payment of at least 20.

So for a 100000 mortgage youd need a down payment of 20000 excluding closing costs and taxes. The effective property tax rate in Florida. An all-time low for rates.

Mortgage calculator results are based upon conventional program guidelines. In reality the cost of such a loan at the then prevailing rate of 7 would have been closer to 1700 per month if one wanted the loan to amortize in 30 years included other expenses like property taxes PMI and homeowners insurance. This calculator will compute a mortgages monthly payment amount based on the principal amount borrowed the length of the loan and the annual interest rate.

The loan is secured on the borrowers property through a process. The most common loan terms are 30-year fixed-rate mortgages and 15-year fixed-rate mortgagesDepending on your financial situation one term may be better for you than the other. Using our mortgage rate calculator with PMI taxes and insurance.

The cost of PMI varies greatly depending on the provider and the cost of your home. The most common home loan term in the US is the 30-year fixed rate mortgage. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Total monthly mortgage payment. After the initial introductory period the loan shifts from acting like a fixed-rate mortgage to behaving like an adjustable-rate mortgage where rates are allowed to float or reset each year. Monthly Taxes Insurance and PMI payment.

Second mortgages come in two main forms home equity loans and home equity lines of credit. By the end of the mortgage term in the year 2033 by contrast the interest payment would be only 189 and the principal would be a whopping 41187. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term.

Lets take a moment to go through the various moving parts of the home loan calculator to get a better. Looking to live in one of North Carolinas larger urban areas. The median home value in Charlotte is 200500.

In many countries 25-year mortgages are structured as adjustable or variable rate loans which reset annually after a 2 3 5 or 10 year introductory period with a teaser rate. This calculator figures monthly mortgage payments based on the principal borrowed the length of the loan and the annual interest rate. It does not include escrow costs such as mortgage insurance homeowners insurance and property taxes.

Interest Rate APR. The monthly cost for a 200000 mortgage was about 1200 per month not including taxes and insurance Post 2008 rates declined steadily. Total monthly mortgage payment.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan.

Online Scientific Calculator Scientific Calculator Basic Calculator Scientific Calculators

The Buyers Guide To Closing Costs Florida Realtors Home Buying Checklist Real Estate Education Real Estate Buyers

Pin On Tithes

Ana Rosa Valentines Gift Guide What Dreams May Come Beautiful Friend

28 Sheet Templates In Word Free Premium Templates

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortizatio In 2022 Mortgage Amortization Calculator Amortization Schedule Amortization Chart

It Can Be Yours Building A House House Styles Dream House

A Federal Housing Administration Fha Loan Is A Mortgage That Is Insured By The Fha And Issued By An Fha Approved Lende Fha Loans The Borrowers Mortgage Loans

9 Hidden Costs That Come With Buying A Home Buying First Home Buying Your First Home First Home Buyer

28 Sheet Templates In Word Free Premium Templates

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information Fha Loans Refinancing Mortgage Mortgage Loans

How Much House Can I Afford Buying First Home Mortgage Marketing Home Buying Process

Financial Advisor Business Plan Template Lovely Create A Business Plan In Excel Personal Financial Planning Business Plan Template Business Plan Template Free

Amp Pinterest In Action In 2022 Amortization Chart Amortization Schedule Mortgage Amortization Calculator

Mortgage Calculator

Refinance Mortgage Calculator Mls Mortgage Refinance Mortgage Home Refinance Free Mortgage Calculator

Monthly Amortization Schedule Excel Download This Mortgage Amortization Calculator Template A Amortization Schedule Mortgage Amortization Calculator Mortgage